2026 Western New York (Univera) Pricing & Plan Designs

🩺 2026 Western New York (Univera) Retiree Health Plan Preview – SPANY / BCPA

The Statewide Purchasing Alliance of New York (SPANY) is pleased to announce the 2026 Medicare Advantage (MA-Only) and Medicare Advantage Prescription Drug (MAPD) plan offerings available through the Broome County Purchasing Alliance (BCPA) in partnership with Univera BlueCross BlueShield.

These plan options are designed specifically for public sector employers across Western New York — including counties, towns, villages, school districts, and BOCES — to deliver comprehensive retiree healthcare coverage, stable renewal rates, and substantial long-term savings through pooled municipal purchasing.

Broker-Friendly by Design

The Statewide Purchasing Alliance of New York (SPANY) is a broker-friendly program. Participating groups have the flexibility to retain their existing broker of record or, if preferred, designate our SPANY team as their broker. The choice is entirely yours — we work seamlessly with both models to ensure a smooth implementation and ongoing support, no matter which option you choose.

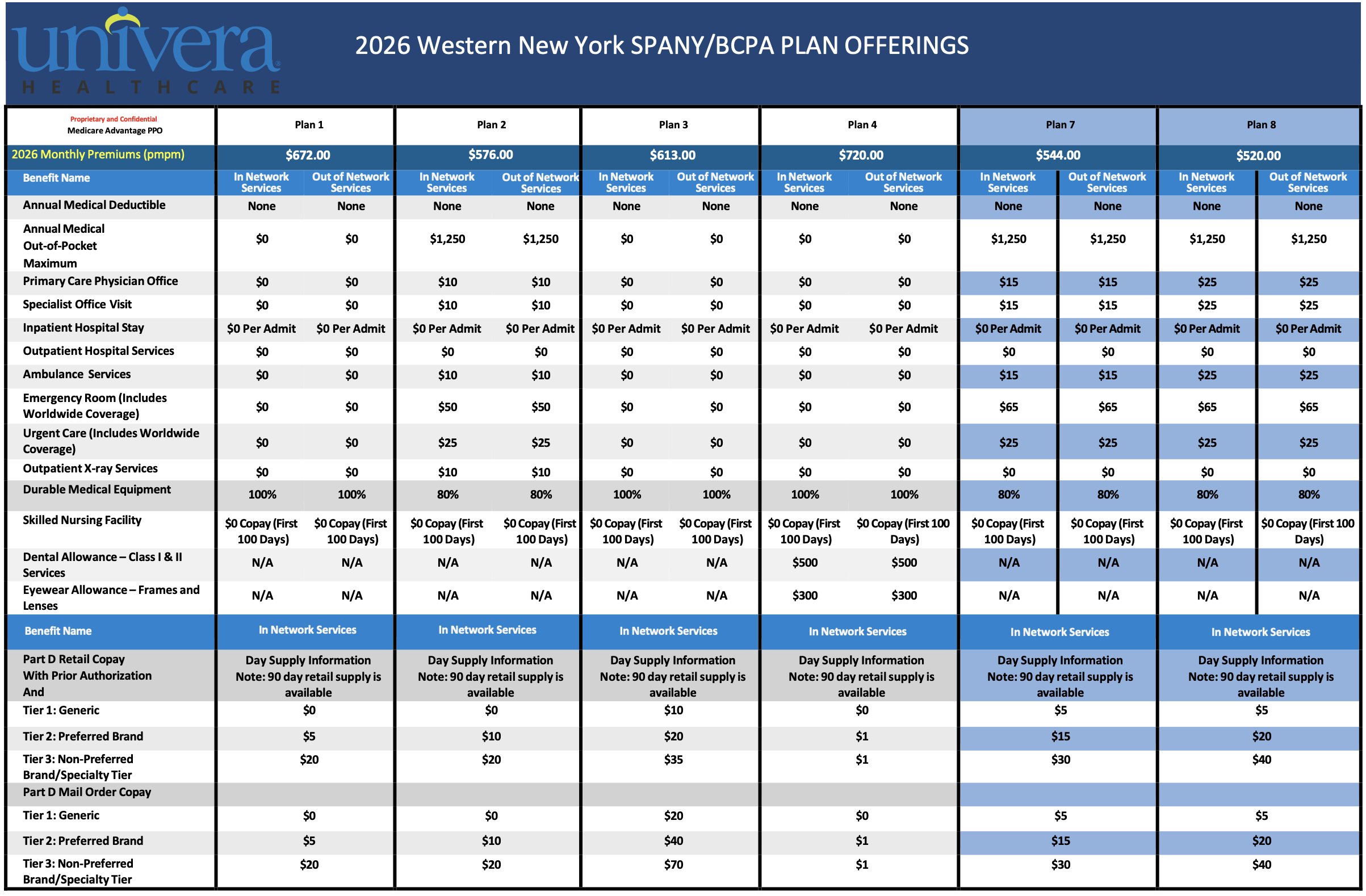

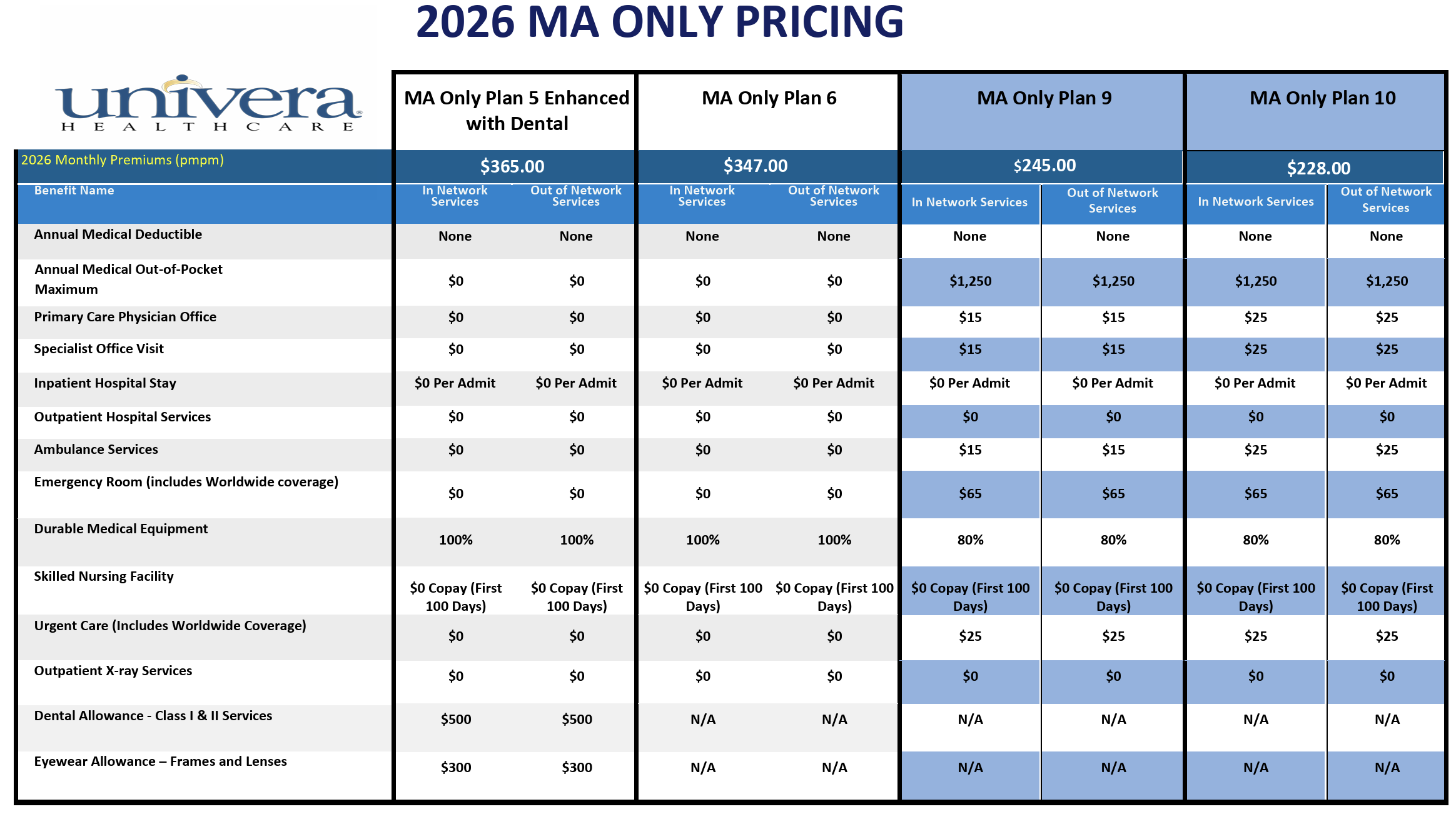

🩺 2026 Western New York (Univera) Plan Options & Monthly Premiums

(Effective January 1, 2026 – December 31, 2026)

| MAPD PPO Plans (with Rx Coverage) | Monthly Premium | MA-Only PPO Plans | Monthly Premium |

|---|---|---|---|

| Plan 1 – $0/$5/$20 (1x) | $672.00 | Plan 5 – MA-Only (Enhanced Dental) | $365.00 |

| Plan 2 – $0/$10/$20 (1x) | $576.00 | Plan 6 – MA-Only | $347.00 |

| Plan 3 – $10/$20/$35 (2x) | $613.00 | Plan 9 – MA-Only | $245.00 |

| Plan 4 – $0/$1 (1x) | $720.00 | Plan 10 – MA-Only | $228.00 |

| Plan 7 – $5/$15/$30 (1x) | $544.00 | ||

| Plan 8 – $5/$20/$40 (1x) | $520.00 |

💡 All premium rates above are finalized figures for the 2026 plan year. Any premium increase in 2027 will be capped at no more than 7.5%

📌 Important Program Details

✅ Carved-Out Pharmacy Benefit: Prescription drug coverage for MAPD plans is carved out and administered separately under Univera’s commercial pharmacy benefit. It is not managed directly by the medical plan.

✅ Guaranteed Rate Protection: Premium rates shown above are finalized 2026 figures and require no rounding adjustments.

✅ Renewal Stability: Future premium increases are capped at 7.5%, providing predictable budgeting and multi-year financial stability for municipalities.

⚖️ Key Federal Policy Changes Impacting 2026

-

IRA Part D Redesign: Establishes a $2,100 annual cap on out-of-pocket prescription drug costs for all Part D beneficiaries.

-

Medicare Prescription Payment Program (M3P): Offers retirees the option to spread prescription costs monthly throughout the year.

-

Medicare Wage Index Adjustments: Driving changes to plan cost structures and reimbursement formulas nationwide.

These shifts underscore the importance of proactive planning — and SPANY’s 2026 Univera model is fully aligned with these new federal requirements.

📞 Interested in Reviewing Plan Designs or Savings Projections?

Whether you represent a county, town, village, school district, or BOCES, SPANY’s pooled purchasing model is built to deliver better benefits, more stable budgets, and substantial savings — regardless of group size.

Contact our team today to review plan designs, discuss implementation timelines, or request a customized savings analysis for your organization.